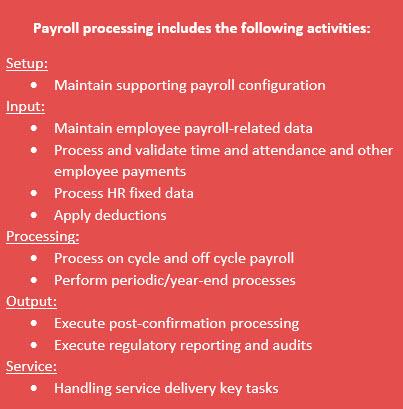

From the perspective of employees, payroll may seem like a relatively simple process (e.g., Did I get paid on-time and correctly or not?), but behind the scenes are many complicated moving pieces. Payroll processing involves all of the activities and tasks behind the scenes involved in paying employees (see inset list), including maintaining employee data, applying payroll deductions, processing payroll, and responding to the range of payroll-related service requests and employee questions. Mistakes in the process can result in errors in people's pay that then have to be subsequently corrected and/or penalties and fines for not complying with local or national rules and regulations.

While the payroll process done right comprises many intricacies in a single-country, the process complexity is greatly magnified when you add other countries into the mix for a global payroll management responsibility. The following sections discuss a rationale and methodology for developing a business case for global payroll management, adapted from ADP's Business Transformation Practice (BTP).

Business case for global payroll: Definition and rationale

While there are many qualitative or "soft" benefits of streamlining and standardizing into a consolidated global payroll management approach, the hard dollar cost of such an investment can be significant, and generally a CFO will not be swayed to make such an investment without attempting to articulate the estimated costs and benefits to the extent possible. In addition, global payroll implementations add additional complexity because of the disparate geographic nature of the investment. For example, an international payroll transformation (compared to domestic payroll management alone) involves:

- much larger scope and complexity,

- multiple countries with different laws and compliance requirements, currencies and operating environments,

- a higher level of risk,

- a larger financial investment, and

- a greater time commitment.

This is where a business case comes into play. A business case details the explicit, tangible estimated costs and benefits of the investment(s), as well as the qualitative rationale, and justifies the transformation project for what is generally a long-term commitment of finite resources. Ultimately, the business case for consolidating international payroll management provides the justification for change.

Start with strategy

Before working on its business case, however, an organization needs to first determine its strategy for global payroll processing. Strategy defines the desired future state operating model for international payroll management. ADP's BTP advises clients to think through the decision points within four essential components of global payroll strategy as a prerequisite to business case development:

- Technology requirements and enablement

- Service delivery and governance

- Standardization and optimization and

- Roles, responsibilities and full time employee specialization.

The business case, in turn, captures the reasoning for implementing the strategy.

Creating a business case for global payroll management

Once an organization has defined its global payroll strategy, it will likely need a business case to justify the strategy to key stakeholders. The business case should include an executive summary, a financial analysis, a risk and efficiency analysis, a deployment strategy and service delivery strategy.

Executive summary

In the executive summary, the organization articulates the problem(s) it is trying to solve with a global payroll solution. For example, technology may be scattered across multiple providers and in-house solutions, each creating unique service levels and contractual requirements, and this creates a challenge when reporting on valuable workforce and payroll data. Another issue may be that payroll operations and service delivery are operating locally without regional or global governance, and that transactional work is distributed across a high-touch environment at a time when payroll talent is scarce.

Ultimately, an organization's justification for global payroll management is unique to its business. However, many will agree that improving data security, data integrity, data visibility and measurement, plus having better governance, business continuity, efficiency, scalability and delivering a unified user experience are collectively driving their decision to implement a global payroll solution.

Total cost of ownership

The total cost of ownership (TCO), or cost-benefit analysis, should include both hard- and soft-dollar costs. Hard-dollar costs compare the current and future technology and labor costs, while soft dollar costs demonstrate expected savings through cost avoidance and cost reduction. Don't forget to include one-time implementation fees in the TCO analysis.

When comparing current technology costs to a global solution provider, be sure to review current contracts for variable fees such as licensing, disaster recovery, maintenance, upgrade, integration, consulting, IT support and any other fees. In addition, the assessment of labor costs should consider all the individuals that perform payroll activities including HR, finance, shared services, and off-shore resources.

Additionally, it is important to take into consideration the soft dollar costs an organization can expect to save. For example, the BTP estimates (based on market benchmarks plus internal ADP subject matter expertise) that gains from automation and efficiencies can range, on average, from two to three percent of total gross payroll. This includes gains from eliminating outdated configurations, reducing compliance penalties, improving error rates, and general process improvement.

Deployment strategy

Once you have the green light on the project, the next step is to determine the timeline, the cluster of countries that are launched together and the approach to implementing the organization's desired service model. The most desirable approach is to deploy the service model alongside the technology in parallel. In determining the order in which the countries are deployed, consider the region, time zone, language, service readiness, and current contract end dates.

Service delivery strategy

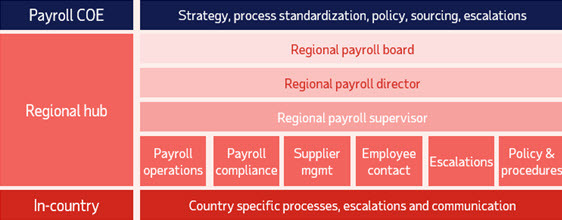

From a leading-practice perspective, a global payroll governance structure should have a Center of Excellence (COE) led by the global payroll process owner that oversees policies and standardization, with regional hubs handling payroll operations, compliance, service center, and escalations. Then, there will be certain processes, escalations and communications handled at the in-country level. This is known as the "hub and spoke" model (Figure 1).

Figure 1

Lastly, the organization will need to evaluate the requirements, skills, and specialization of its people today and how they meet the needs of the future. For example, if the organization is in a decentralized model and is considering a single or hybrid technology approach to gain efficiencies, will it leverage current staff and retrain/upskill?

Conclusion

Moving to a unified global payroll management approach requires a transformation effort not for the faint of heart, but well worth it for companies operating in the international marketplace. Senior leaders will be best swayed to payroll transformation by those payroll teams that are able to articulate their hard and soft dollar costs and the benefits of a global payroll approach.

This story originally published on SPARK, a blog designed for you and your people by ADP®.