In the shape-shifting wake of COVID-19, companies the world over are renewing efforts to improve operational efficiency and cut costs, anticipating the difference these actions could make to their longer-term business performance.

And if recent M&A (mergers and acquisitions) stats¹ are any indicator, many companies are hurtling into headlong growth mode, whether they’re established international players or taking their first forays into one or two markets abroad. Whatever their motivations, the pandemic served to reinforce the risk of overlooking chronically inefficient business functions, with underperforming payroll processes top of the list.

A disjointed, error-ridden payroll process can seriously hinder any company’s speed to market, undermine growth strategies and impact revenue targets. Just as you’re setting up operations in new countries, you need payroll to pull its weight as a strategic business asset — not thwart your ambitions.

So it stands to reason that almost a third (32 percent) of senior individuals in organisations of over 1000 employees globally identify “access to greater reporting analytics, for reliable insight that can truly inform company strategy and planning” as a clear benefit that a payroll transformation could help them deliver.²

Why focus on payroll, and why now?

The pandemic exposed lingering structural problems in payroll, revealing a pressing need for the function to evolve from unpredictable and reactive to data-driven and strategic. These issues look set to intensify as firms face ongoing difficulties in recruiting payroll professionals with sufficient strategic, technical and analytical know-how. In fact, there were signs that the talent shortage was starting to bite even before COVID-19 took hold: “Employers surveyed stated payroll was by far the most difficult area within accounting support to attract quality candidates.”³

Suddenly, executives came face to face with the threat to morale, the prospect of bad press and the regulatory fallout from not paying their people correctly. HR leaders, alarmed by these high-profile failures in the payroll function, now find themselves scrambling to play catch-up and build in the resiliency essential to future-proof the smooth running of business operations.

At the same time, many companies have begun to target employee wellbeing as an area of improvement. Here, payroll can play a major role — paying staff accurately, and on time, is a basic tenet of the employee wellbeing ‘psychological contract’. Switched-on employers realise that helping workers develop their financial literacy skills can be a differentiating factor for businesses battling to maintain consistent staffing levels (especially now, as tight labour market conditions globally show no signs of letting up).

Invest in tech for efficiencies that cut costs and risk

A cloud-based, unified solution should scale and grow with your business. When evaluating the relative merits of global payroll technology options, ask yourself these essential questions:

- How will this new system demonstrably improve efficiency across our current payroll operations?

- Beyond operational efficiency, has the vendor designed their payroll platform specifically to expedite business growth efficiency?

- In what ways will this global payroll services provider help our company hit the ground running in our new market(s)?

Optimising payroll? Cost efficiency counts too

‘Improving payroll efficiency’ extends beyond how easy your team finds it to accurately calculate gross-to-net earnings, apply and comply with nuanced local labour laws and disburse salaries into employees’ bank accounts every pay period. On top of tackling the more obvious pain points in the payroll process (standardising pay dates, whittling down the number of separate systems, cutting out manual interventions and input) there’s the challenge of achieving cost efficiency across your payroll function.

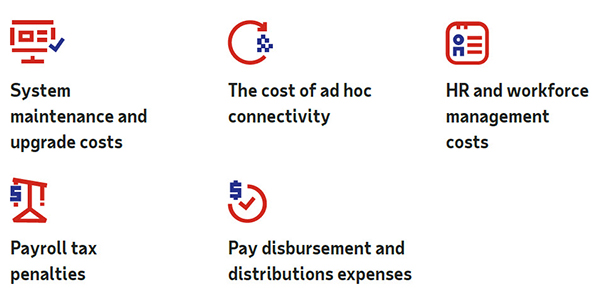

Typically, you’ll be looking to lower costs in the following areas:

Of course, the most significant — and preventable — cost associated with inefficient payroll operations are the regulatory fines meted out for non-compliance with labour-related legislation. In the Total Economic ImpactTM of ADP Global Payroll study, Forrester® found that, over a three-year period, ADP Global Payroll clients were able to avoid compliance costs of $1.8 million.⁴ Forrester identified cost-cutting opportunities in less well-documented areas, too, noting that companies can realise savings on money movement and reduced currency conversion costs.

Is your internal structure set up for payroll success?

It can be tempting to focus exclusively on technology’s role in driving payroll process efficiency and productivity gains, but what about the people who are following and implementing the payroll process? Does their reporting line impact overall efficiency? In ADP’s 2021 payroll survey², we find that global payroll doesn’t sit neatly under one business function. This means there are several groups of stakeholders with responsibility for the strategic direction of the service — each with their own views of what needs changing. Whether your payroll function is centralised, regionalised, or follows a location specific ‘centre of excellence’ shared service model, the insights to be gleaned from payroll data will be crucial to your workforce strategies as you expand your business abroad. Take a critical look at your internal structure. Does it facilitate your payroll team’s ability to dish up these insights to senior management? If you find it hard to source this information quickly, that’s a big red flag over the efficiency of your payroll operations.

Is your payroll function future-ready?

As your company sets its sights on growth, it’s vital not only to define what payroll execution excellence looks like across your organisation, but to assess your ability to deliver a slickly efficient payroll function in your new markets. Consult our guide to pinpointing your payroll maturity level and identify exactly where you are on your HR digital transformation journey so you can set up a springboard for global growth success.

1. Willis Towers Watson, ‘Global M&A to remain strong in 2022 as valuations reach historic highs, putting pressure on deals to achieve meaningful value’, 2022

2. ADP, The potential of payroll: Global payroll survey 2021

3. AccountAbility, 2019 Market Trends Report

4. The Total Economic Impact™ Of ADP Global Payroll Study, Commissioned by ADP, 2020